All Press Releases for July 18, 2024

Topo Finance and Compose[d] Launch The Individual Cash Calculator to Help Individuals Leverage the Climate Power of their Personal Banking

New tool empowers individuals to align their banking choices with climate-positive actions.

"Around the world, individuals are becoming increasingly adept at applying a climate lens to how we spend our money," said Topo Finance's Founder and Executive Director Paul Moinester.

NEW YORK, NY, July 18, 2024 /24-7PressRelease/ -- Topo Finance and Compose[d] are excited to release The Individual Cash Calculator. With this tool, which builds on Topo's pioneering research about the climate impact of corporate cash, individuals can measure both the emissions that their banking enables and the climate benefits of moving their money to greener banks. By doing so, the tool helps illuminate the fact that where individuals bank is one of the most important consumer climate decisions individuals make.

The power of banking as a climate action is rooted in how banks lend and invest money. When a customer deposits money in a bank, that money does not just sit there accruing interest. Rather, banks lend it out across the economy to everything from energy projects to mortgages.

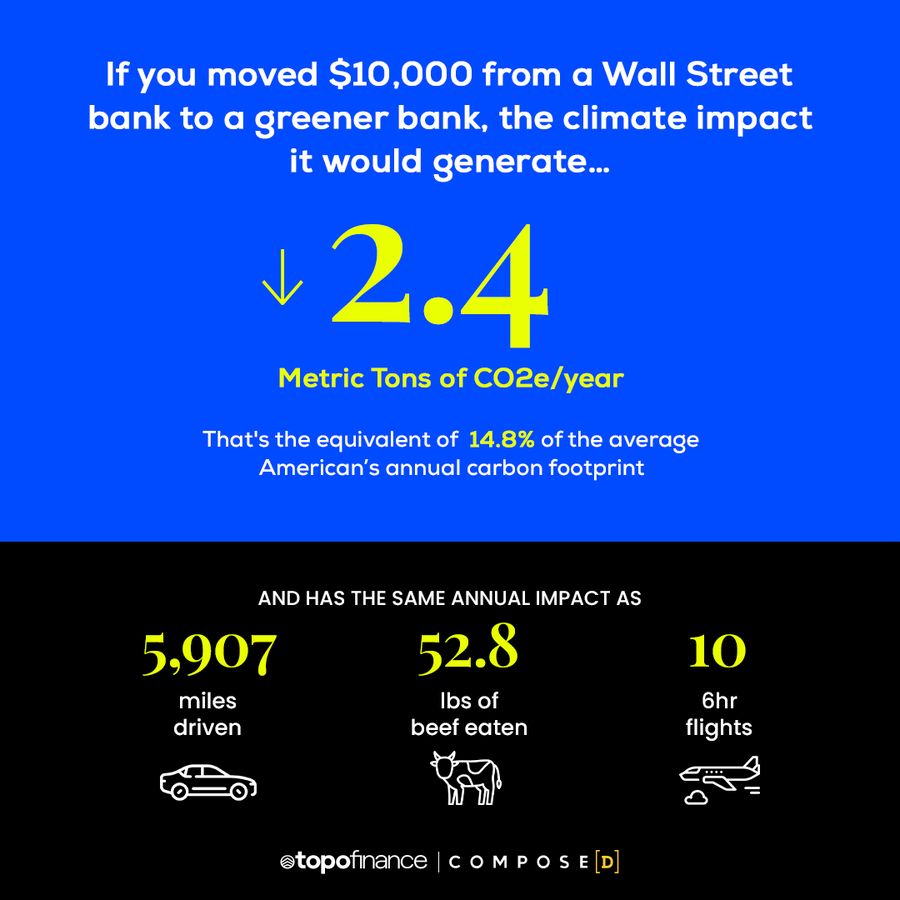

As a result, every dollar in the bank has an associated carbon footprint, and that footprint can vary dramatically depending on a bank's lending practices. In fact, Wall Street banks, on average, generate 400% more emissions for every dollar they lend compared to greener banks in the U.S.

"Around the world, individuals are becoming increasingly adept at applying a climate lens to how we spend our money," said Topo Finance's Founder and Executive Director Paul Moinester. "However, what The Individual Cash Calculator illuminates is that applying this same climate lens to where we deposit our money can be as impactful as how we spend it, which is why everyone needs to harness their banking as a powerful climate lever."

"Exercising agency over how our banks lend and invest our money is perhaps the single most effective consumer action individuals can take to effect systemic impact," said Jason Parkin, founder, president, and chief creative officer at Compose[d]. "That's why we were excited to partner with Topo Finance and build a tool that enables individuals to understand the climate impact of their banking and embrace this accessible, low-cost, and powerful climate action."

We have long known that personal banking is an overlooked and promising climate lever. However, the research Topo Finance conducted that underpins this tool illuminates that this intervention is far more powerful than we previously believed:

Moving your money from a carbon-intensive bank to a greener bank could reduce the greenhouse gas emissions it generates by an average of 80%.

If you bank with a U.S. carbon-intensive bank, you may be indirectly lending up to 20–30% of your money to the industries most responsible for fueling the climate crisis, such as energy production, utilities, mining, and large-scale manufacturing.

If you move $5,000 from a carbon-intensive bank to a greener bank, the annual indicative emissions reduction that switch would generate would be greater than adopting a vegan diet.

Topo Finance and Compose[d], in partnership with BankFWD, built The Individual Cash Calculator. To learn more about the power of personal banking as a climate solution, you can read the report Topo Finance and Project Drawdown co-produced, "Saving (for) the Planet." To find a green banking option that might be right for you, please visit Bank for Good.

About Topo Finance — topofinance.org

Topo Finance is a nonprofit organization dedicated to transforming the financial sector into a powerful force for creating a more just, regenerative world. It works to actualize this future by conducting pioneering research and developing pragmatic solutions that enable all organizations and individuals to maximize the positive impact of their finances.

In 2022, Topo Finance ushered the field of climate-aligned corporate treasury management into the sustainability mainstream with the publication of The Carbon Bankroll 1.0 report. Since then, Topo has established itself as an industry-leading expert and consults with the world's largest corporations on how to align their financial management with their climate objectives.

About Compose[d] — composedcreative.com

Compose[d] is a digital strategy and creative services agency dedicated to driving positive impact. It is a highly experienced team of curious and knowledgeable creatives dedicated to delivering a positive impact with premium digital services that are mission-driven for the success of its clients, community, and the planet.

As a Certified B Corp®, Compose[d] leverages its expertise to help clients—from established global brands to up-and-coming challengers across all industry verticals—effectively develop and authentically communicate their sustainability and climate efforts.

# # #

Contact Information

Topo Finance

New York, New York

United States

Voice: 5413256234

E-Mail: Email Us Here

Website: Visit Our Website

Blog: Visit Our Blog

Follow Us: