All Press Releases for September 09, 2024

CEI Institute partners with Filene Research Institute to Address Racial Economic Equity

An Outreach to Those Not Previously Reached

Credit unions across the nation can begin to engage with individuals they had previously not reached, creating significant impact for individuals, communities, and their membership growth.

ST. AUGUSTINE, FL, September 09, 2024 /24-7PressRelease/ -- In the first-of-its-kind incubator project initiated by Filene Research Institute, CEI Institute was engaged to coach several selected credit unions and their community partners to develop solutions focused on Racial Economic Equity (REE) in underserved communities.

A Movement for Social Innovation

The REE Incubator was established to tackle racial economic disparities by fostering significant collaboration between credit unions and community stakeholders. By utilizing Filene's innovation framework alongside the expert coaching methodology of CEI Institute, the initiative was launched to develop effective solutions to mitigate racial disparities. Over 18 months, the cohort-coaching model brought together 9 credit unions, 11 community partners from New York to Hawaii, enabling a network of support that would test the idea that organizations addressing societal problems can be stronger together while creating greater improvements in economic equity within their communities.

"Collaborating with credit unions and community partners through our Racial Economic Equity Incubator has been a profoundly inspiring experience," expressed Filene's Head of Incubation, McKaye Black. "The significant impact each team has achieved in advancing racial equity in their communities, coupled with the thoughtful support and camaraderie they've extended to one another, truly reflect the core mission of credit unions – people empowering people."

An Outreach to Those Not Previously Reached

The chosen credit unions each collaborated with a CEI Institute coach to develop comprehensive solutions to enhance the well-being and empowerment of their community. Representative programs devised by the credit union and their partners covered a wide range. The cohorts created solutions ranging from down payment assistance and grant programs, to matching savings initiatives, financial empowerment services, educational resources and financial tools, car loans, assistance in credit building, and establishing financial goals. One entity offered instruction in high school entrepreneurship and money management, while another engaged 18-25 aged individuals in financial empowerment solutions.

Peter Holmes, CEO of CEI Institute stated, "We are at the conclusion of the initial phase of our efforts. Through these select projects, credit unions across the nation can begin to engage with individuals they had previously not reached, resulting in significant impact on both individuals and communities, as well as fostering new opportunities for membership growth. Consider the potential of scaling REE work."

The CEI Institute participating coaches included Peter Holmes, Beverly Wolfe, Howard Holley, Terri Quinton and Shellee Mitchell. The coaches offered unwavering support and mentorship to the participants throughout the program. Coaching provided the "catalyst" to help the teams better focus their solutions and examine ways to make it scalable and repeatable by other credit unions and their partners. Their dedication to fostering growth and innovation within the credit union movement was evident in the success of the capstone projects.

A Testament to Community Impact – The Catalyst Award

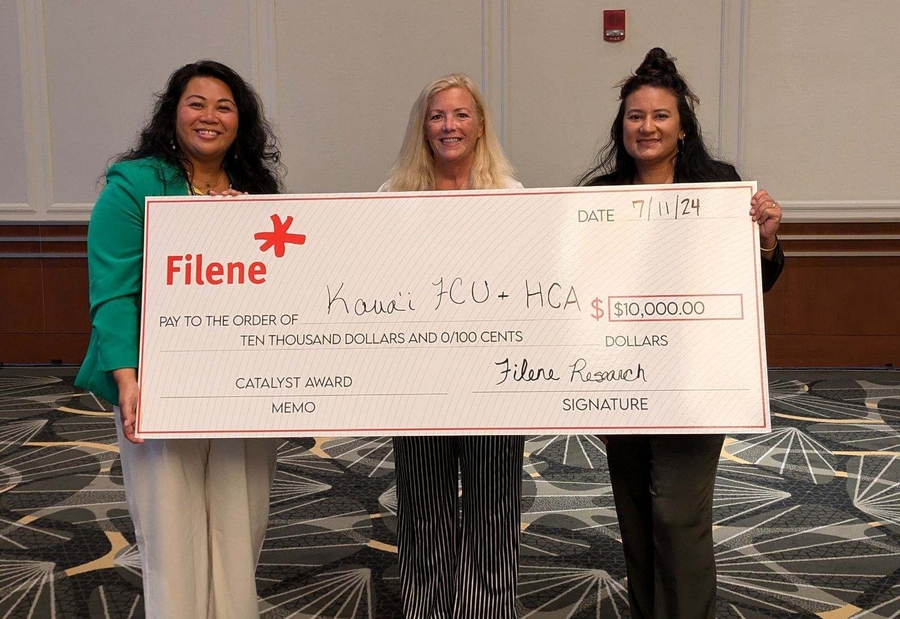

To mark the culmination of the initial phase of the REE Incubator Program, Filene showcased the capstone projects at their Spark! 2024 conference on July 10, 2024. A Catalyst Award winning project was announced amidst a gathering of credit unions, community partners, and industry experts demonstrating the innovative spirit and commitment to social change that is the hallmark of the credit union movement.

The Catalyst Award project's top two finalists presented their stories to the entire Spark audience. They were celebrated for their exceptional contributions to economic equity.

The Catalyst Award Winner was Kaua'i Federal Credit Union with Hazelmae Overturf and community partner, Hawaiian Community Assets with Makana Reilly, coached by CEI Institute's Beverly Wolfe. The team demonstrated a profound commitment to serving their community and addressing racial economic disparities through a down payment assistance program and cesspool-to-septic conversion green lending program to build Native Hawaiian homeownership on Kaua'i. They received $10,000 from sponsor organizations Target Foundation and TruStage Foundation, to continue the project work which is projected to reach $1 million in green lending in 2024. In closing their presentation, Overturf and Reilly shared a Native Hawaiian saying: "No task is too big when done together by all."

Second place went to Veridian Credit Union with Angela Weekley, in collaboration with their community partners Iowa Heartland Habitat for Humanity, House of Hope, 24/7 Blac, Try Pie Bakery and City of Waterloo. The team was coached by CEI Institute's Terri Quinton. Their "Achieve "collaboration delivered a financial empowerment program to serve African Americans in their community. Weekley stated their project goal together "is to make sure African Americans in Blackhawk County are liberated to have financial stability and build wealth." In the short period, the Achieve collaboration had 108 individuals access homeownership education, 161 received financial mentoring, 30 became homeowners, 7 received car loans and 71% increased their savings or reduced their debt.

Other participants in the Catalyst Award presentations were:

• MSU Federal Credit Union and GreenPath Financial Wellness coached by CEI Institute Peter Holmes

• Chartway Credit Union and Norfolk State University coached by CEI Institute Shellee Mitchell

"Credit unions are all about people, and while the business side matters, it's the hard work of dedicated teams that keep the wheels turning!" said Christie Kimbell, Executive Vice President at Filene Research Institute. "So, how do you tackle a challenge as massive as this? One bite at a time! It's all about rolling up our sleeves and making a difference, credit union by credit union, community by community!"

For more information about the CEI Institute coaching methods and community entrepreneurship and innovation activities, visit www.CEIInstitute.org. For those interested specifically in the REE Incubator projects, visit www.filene.org/REE.

About CEI Institute: The Community Entrepreneurship and Innovation Institute (CEI Institute) is designed to offer no-cost business consulting help to under-represented communities for business ownership and entrepreneurship because of age, ethnicity, gender, orientation, or race. The Institute is also designed and organized to support both new, emerging and existing businesses. Our mission is to offer direct consulting services to clients who are looking to start a business, sustain a business or grow/expand a business. We support government entities and municipalities in assessing the impact of their existing policies to encourage entrepreneurship within their communities and non-profits who advocate for inclusivity in entrepreneurship and business ownership. For more information, visit www.CEIInstitute.org.

About Filene: Filene Research Institute strengthens organizations through innovative research and incubation to improve consumer financial well-being. As an independent cooperative finance think tank, Filene's membership network connects a community of leaders and bright minds to change lives through innovation, truth and cooperation. In addition to delivering cutting-edge, actionable academic research, Filene also provides incubators to test and scale solutions, events to spark organizations into action and advisory services to help accelerate and implement innovation. For more information, visit filene.org and follow on LinkedIn.

# # #

Contact Information

CEI Institute

St. Augustine, FL

United States

Voice: 215-356-7039

E-Mail: Email Us Here

Website: Visit Our Website

Follow Us: